Why I Became a Financial Advisor

I’m not your typical financial advisor.

When I was 12, I had an overly lucrative paper route. I remember I had this little red “cash box” that was stuffed with hundreds of dollars. At the time, my Dad was about 40 and getting serious about investing and building wealth. He told me about mutual funds.

“Mutual what???” I said. Then peppered him with questions.

My Dad put my paper route money into the “Dreyfus New Leaders” mutual fund for me. My very first shiny new mutual fund. It was fun to get the statements and watch the money grow. It left an impression on me.

At age 16, while sitting around a cabin in northern Michigan with some high school friends, I encouraged them to buy mutual funds and gave them some tips on how to find the right ones. (After an awkward silence, the conversation quickly turned back to girls).

In my early 20s when I was an engineer at Dell, Inc. in Austin, TX, I was appalled at the poor 401k choices we were offered. I politely lobbied (harassed) the HR dept to get better choices. They relented and got rid of the worst offenders with screaming high fees.

Who does that?

That was the start of my passion for finances and has led to me to where I am today.

From Newspaper Routes to Morningstar

After graduate school at the University of Chicago, I entered the financial industry as a lead analyst for Morningstar in 2007. My eyes were opened to how complex and opaque the financial industry was for the everyday investor.

There was a bewildering array of investment choices–ETFs, mutual funds, individual stocks, alternative funds, 529 College Savings Plans… and each of those had hundreds (even thousands) of options. Information overload.

It was clear to me that 95% (that’s conservative) of financial products were indeed “toxic waste”–as the PhD neuroscientist-turned-investment advisor William Bernstein elegantly puts it.

To make matters worse, most of these investment products were “sold”, not bought. Many financial advisors get paid by commissions or other complex pay schemes. To their clients, it feels as if they are getting “free” advice and service.

In reality, the commission model is so complex and opaque most clients would be shocked if they could see a bottom-line total of how much their advisor makes on their hard-earned money. I became disheartened by the focus on commissions and how that motivation distracted financial planners from the actual needs of their clients.

My conclusion: financial planning and building wealth was overly complex.

I could see it on the faces of friends and family that asked me for advice when I was still working at Morningstar. They were utterly confused. I knew that people wanted a financial plan that was understandable and accessible. They wanted a financial advisor who would be their strongest advocate and look out for their needs and goals. Moreover, clients deserve to have full transparency on what fees they are paying for financial advice; a simple invoice to see exactly what their advisor is charging.

Time to Change Things Up

Instead of letting myself get disillusioned and cynical, I turned my knowledge and more than two decades of experience into a unique and creative concept that led me to me found my financial planning company, Pathway Financial, in 2011. My goal was and still is to build wealth for my clients in a simple, transparent way that is personalized to each client’s needs and built on proven, evidence-based investment frame-work.

I want to do something different in the financial industry. To offer something new and accessible to clients. I want my clients to feel in control of their money and their financial future.

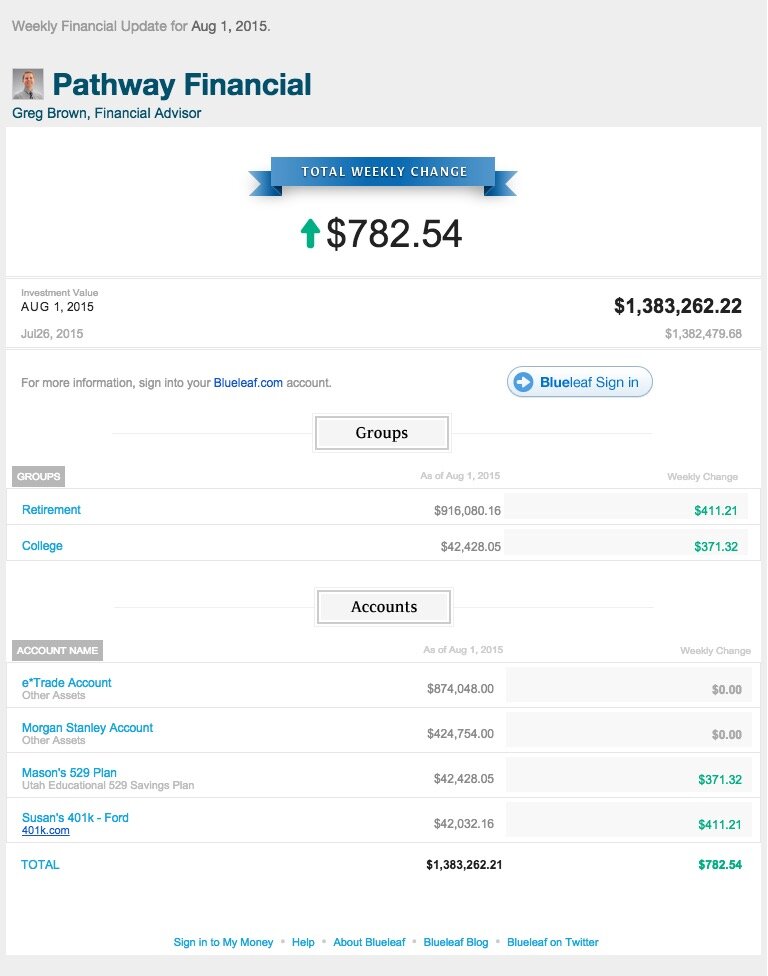

That’s why every client gets access to our powerful online portal, where they can see all their finances in one place. They see all their investment accounts, 401k accounts, 529 College Savings accounts, checking accounts, credit card accounts, mortgages, loans, home values, and more. All accessible via an online portal and updated daily.

Clients even get a weekly email updates of all their finances. As one client put it:

I feel like I finally have a pulse on my money. I’m not overwhelmed with details and I get just what I need from your weekly email.

This level of transparency is unheard of in the financial industry.

We’ve created a service that saves you time, builds wealth smarter, offers total transparency, and gives you expert advice for the whole ride.

How I Can Help

Life is busy and complex.

There’s no reason to overcomplicate your personal finances and investments. I set out each day to help people simplify their financial lives so they can get on with life. I am passionate about teaching my clients so that there is clarity instead of confusion. The knowledge that I pass on creates peace of mind and awareness in people’s lives, and that is something we all need more of!

Want more advice on making the most of your money? Schedule a no-obligation chat with me below.